If you are using HDFC bank for online transfer of money to another account, you should add the beneficiary details (account number and other details of the receiver) first. Then you should wait till HDFC enables the new beneficiary for fund transfer. After they enable the beneficiary, you can start transferring money. The time to enable a beneficiary account depends on the bank policy (right now it is 12 hours).

It is important to note that there is a maximum number of beneficiary registration for each type of fund transfer in HDFC bank (Currently it is 50 beneficiaries per each type of transfer).

This article is about deleting a no longer needed beneficiary from your HDFC net banking account.

It seems HDFC has removed the feature to delete existing beneficiaries, but we can use the edit feature to alter all information we added. The instructions listed just below this update explains this procedure.

Automatic Deduction Of Money From Account

< ------------------ Old Outdated Steps ----------------------->

If you want to transfer money to another account via net banking, you must add him first to your account as a beneficiary. It is necessary for both NEFT and RTGS.

Money transfer methods RTGS and NEFT are different in the way they work. If you want to transfer money real time without delay, you must use RTGS option. RTGS stands for Real Time Gross Settlement, and you can transfer money by online to accounts in any banks within India without any delay.

You do not need to wait for clearance to accomplished the process. However, banks charge a fee for this type of money transaction and currently, HDFC charges RS 25 for any transaction between 2lakh to 5lakh. If the amount is higher than 5lakh, you must pay Rs 50 as the fee.

RTGS doesn't work on holidays and non-banking time though banks claim real-time transfer. Another issue with RTGS is the higher minimum amount to transfer. We can start RTGS request only if the amount is at least 2lakh.

Another mode of online money transfer by HDFC is NEFT. It stands for National Electronic Funds Transfer, and you can send payments to any third party accounts in India with few restrictions. HDFC charges a small fee for NEFT money transaction depends on the transaction amount.

It is important to note that there is a maximum number of beneficiary registration for each type of fund transfer in HDFC bank (Currently it is 50 beneficiaries per each type of transfer).

This article is about deleting a no longer needed beneficiary from your HDFC net banking account.

Steps to Delete a Beneficiary from HDFC Account

Update (05-04-2015): Automatic Deduction Of Money From Account

- Login to HDFC net banking using the link http://www.hdfcbank.com/

- Click on Funds Transfer on the top menu

- Click on Enquire on the left-hand menu and then click 'View List of Beneficiaries'

- Click on Go button under the Transaction Type. If you are going to edit a beneficiary created for NEFT, you must click the Go button under NEFT. The same rule applies to IMPS, RTGS, etc.

- Scroll to the bottom of the list where you can see two buttons Delete and Add New. Select the beneficiary name by choosing using the radio button and click the delete button to remove it from your account.

- Now select the beneficiary by choosing the radio button and click Edit. Here you can edit the account type, name, and email id. Please note that you cannot change the beneficiary type or the account number.

< ------------------ Old Outdated Steps ----------------------->

- Login to HDFC Netbanking account

- Click on Third Party Transfer

- Click on View List of Beneficiaries on the left-hand side

- Select the Transfer type and click View

- Select the beneficiary and click delete

- Now you need to confirm the deletion of the beneficiary

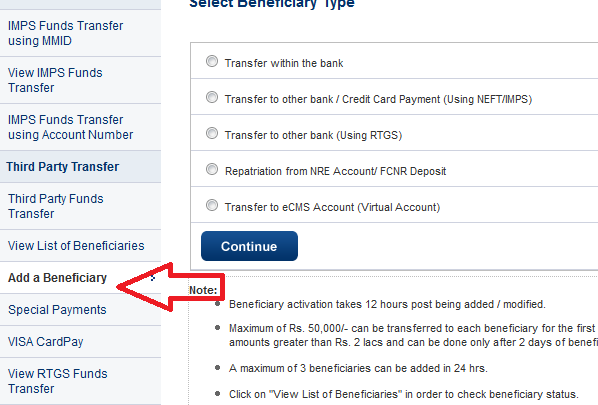

How to Add a new Beneficiary

If you want to transfer money to another account via net banking, you must add him first to your account as a beneficiary. It is necessary for both NEFT and RTGS.

- Log in to your account

- Click on Third Party Transfer

- Click on Add a Beneficiary

- Click on the Continue button and enter the account details to which you want to send money.

Money transfer methods RTGS and NEFT are different in the way they work. If you want to transfer money real time without delay, you must use RTGS option. RTGS stands for Real Time Gross Settlement, and you can transfer money by online to accounts in any banks within India without any delay.

You do not need to wait for clearance to accomplished the process. However, banks charge a fee for this type of money transaction and currently, HDFC charges RS 25 for any transaction between 2lakh to 5lakh. If the amount is higher than 5lakh, you must pay Rs 50 as the fee.

RTGS doesn't work on holidays and non-banking time though banks claim real-time transfer. Another issue with RTGS is the higher minimum amount to transfer. We can start RTGS request only if the amount is at least 2lakh.

Another mode of online money transfer by HDFC is NEFT. It stands for National Electronic Funds Transfer, and you can send payments to any third party accounts in India with few restrictions. HDFC charges a small fee for NEFT money transaction depends on the transaction amount.