Are you using HDFC Bank for online money transfers? If you use it for the first time, you must add the beneficiary to initiate the fund transfer.

That includes the account number, name, and other relevant information.

After adding the beneficiary, you must wait for HDFC to enable them for fund transfers. Once the bank activates the beneficiary, you can begin transferring funds.

The activation time depends on the bank's policy, which is currently 30 minutes.

It is important to note that HDFC Bank limits the number of beneficiaries you can register for each type of fund transfer. At present, you can add up to 50 beneficiaries per transfer type.

In this article, I will explain how to add a new beneficiary and delete a beneficiary in your HDFC Net Banking account.

Steps to Delete a Beneficiary from HDFC Account

Login to HDFC Net Banking using this link: http://www.hdfcbank.com/.

Click the 'Funds Transfer' in the top menu.

In the left-hand menu, click Enquire, then select View List of Beneficiaries.

Under Transaction Type, click the Go button for the relevant transfer method (NEFT, IMPS, RTGS, etc.).

Scroll to the bottom of the list, where you will find two buttons: Delete and Add New.

To delete a beneficiary:

Select the beneficiary's name using the radio button.

Click the 'Delete' button to remove it from your account.

To edit a beneficiary:

Select the beneficiary using the radio button and click Edit.

You can modify the account type, name, and email ID.

Note that you cannot change the beneficiary type or account number.

I hope I have explained how to edit and delete an existing beneficiary in an HDFC NetBanking account. Now, I will answer some questions from the readers of CoreNetworkZ Tech Solutions.

Pradeep Kumar, a marketing executive in Bengaluru, asked, "Hello Alex, what are all the details necessary to create a new beneficiary in my HDFC bank account?"

Amit Pawan, a regular reader of CoreNetworkZ Tech Solutions, asked, "I want to add one of my friends as a new beneficiary. I know his bank account details but do not know the IFSC code. How do I add him as a beneficiary without adding the IFSC code?"

Julia Sebastian, a web designer from Chennai, asked, "Hello Alex, I removed one beneficiary from the HDFC bank account yesterday. Is there any technical problem with adding her as beneficiary again?"

I will answer their questions now.

The IFSC code of the beneficiary's bank branch is necessary. Without it, you cannot add a beneficiary to your HDFC NetBanking account. I believe it answers Amit Pawan.

About Julia's question, she can add the removed beneficiary anytime. I contacted Akash, my friend, and the HDFC branch manager. He confirmed it.

How To Add a New Beneficiary in HDFC Netbank Account?

Here, I will answer Pradeep Kumar's question. To add a new beneficiary to an HDFC personal bank account, you need:

Beneficiary's name (as per their bank account)

Bank Account Number of the beneficiary

IFSC Code of the beneficiary's bank branch

Bank Name and Branch Details

Let me explain the procedure.

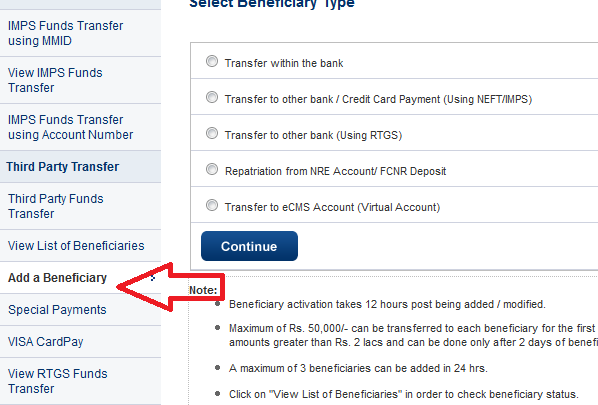

Click the Third Party Fund Transfer.

Click the Add a Beneficiary link.

Click the Continue button and add the necessary information.

Let me conclude today's article now. I believe it helped you understand the process of adding and Deleting a beneficiary from an HDFC personal bank account.

Can you tell me how to add a new Beneficiary in my bank account ? Can I transfer money from my State bank (SBI) account to another HDFC account ?

ReplyDeleteYes.. Its very simple.. You need to activate netbanking + third party transfer to use this feature..

DeleteBeneficiery can be deleted, on the last step where you can edit the beneficeiry there is also one more option to delete beneficeiry.

ReplyDeleteThanks for your correction Nitin. I didn't notice that option. I will check it and update the article.

ReplyDeleteThank you. Much useful.

ReplyDeleteThank you so much . Helpful

ReplyDeleteThanks, It helped a lot!

ReplyDeletenice details

ReplyDeleteThank you so much.. It was very helpful.

ReplyDeleteThank you so much...

ReplyDeleteThanks for your valuable information,this is very useful.

ReplyDeleteThank You , It was a great help.

ReplyDeletethank you

ReplyDeleteTx

ReplyDeleteIts very useful and simple

thank you so much..

ReplyDeletethank you re dost!!

ReplyDeleteHow do I delete it in the app

ReplyDelete@Adrian

ReplyDeleteI have not seen a way to delete the beneficiary list using an App. You may need contact Bank Phone Support to confirm a safe App for this purpose.

thank you brother...

ReplyDeletethanks mate

ReplyDeleteEditing or deleting beneficiary details wil reflect in transaction statement narration or something ?

ReplyDelete@ Unknown

ReplyDeleteIt will not reflect in the transaction statement.

Dear sir / madam

ReplyDeletehow to see the details of deleted beneficiary perticulars in hdfc bank pl send me to my mail id diva3karla@gmail.com

9493542333

pl send reply

@ Prabhakar Divakarla

ReplyDeleteYou cannot see the details of deleted beneficiaries in your account. For that, you need to contact HDFC phone support or visit your branch.

You can get the HDFC support number for your city from the link below.

https://www.hdfcbank.com/personal/need-help/customer-care